Make Your Mediation a Success

Divorce, even just contemplating it, produces more stress than any other life event except for the death of a spouse. And it requires us to be even more analytical, calculated, organized, and decisive than we may have ever been—even at the best of times. Divorce requires us to put our emotions aside and get diligent about understanding our finances.

For many of us that is a difficult, sometimes impossible task because we have no idea where to start. We might not know the passwords to our accounts, what our spending habits actually are, and our total assets and liabilities. And now we need to discuss them, negotiate them, and advocate for ourselves.

And mediation asks us to do just that. So how can you navigate all this and make your mediation a success?

First, Know it’s an Option, but Not Always the Best One

Here’s the rub—mediation doesn’t always work. Especially when you have a spouse that’s looking to be vindicated, find fault, or steamroll the other. If one (or both) parties are coming to mediation fighting to win instead of fighting to resolve, not only could it be dysfunctional and unhealthy, but you’re going to waste a lot of time, energy, and money. So sometimes, especially in situations of domestic abuse or assault, mediation is a non-starter.

But for those that are good candidates for mediation, it’s important to note that just because you’re not fighting to win, mediation isn’t a cooperative process. It’s a process where each party is expected to present their side and then give and take—so it’s vital you know what you want going in and you are armed with the right data.

Case in point: Our client’s husband created spreadsheet after spreadsheet to convince himself (and our client) that he did not need to pay her maintenance because he retired at 55. She hired us to help her understand her financial situation and act as a sounding board in between mediation sessions. Not only did we bring financial clarity, focus, and confidence to ensure she was successful during mediations—we were able to help her advocate for herself and move the needle from $0 maintenance to $120k lump sum buyout. She could move forward post-divorce without worrying about whether he went back to work.

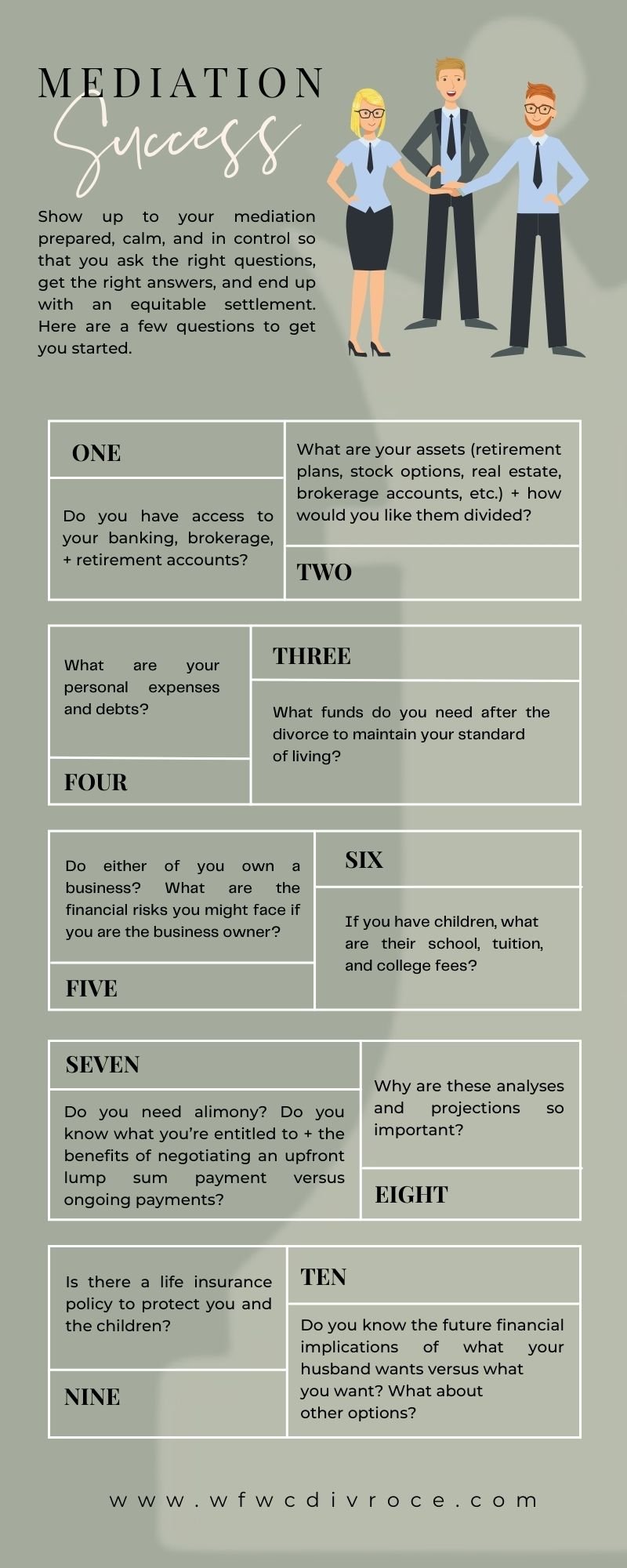

It’s imperative that you show up to mediation prepared, calm, and in control so that you ask the right questions, get the right answers, and end up with an equitable settlement. This starts with knowing where you are at today and what you need to do moving forward can allow you to be more confident through this difficult transition.

Make Your Mediation a Success

Remember, your mediator cannot show any bias for either party’s position in the divorce–but they should be able to run support calculations based on the financial information you provide.

Which is why, if you can’t advocate for yourself, you need to arm yourself with an expert in financial mediation to make sure the process is working for you and that all reasonable prospects for settlement have been considered.

Do you have access to your banking, brokerage, and retirement accounts?

What are your assets (we’re talking all of them: cash, pensions and other retirement plans, stock options, restricted stock, real estate, intellectual property, brokerage accounts, and more)—how would you like them divided?

What funds do you need after the divorce to maintain your standard of living?

What are your expenses and debts?

Do either of you own a business—what are the financial risks you might face if you are the business owner?

If you have children, what are their school, tuition, and college fees?

Do you need alimony? Do you know what you’re entitled to and the benefits of negotiating an upfront lump sum payment versus ongoing payments?

Why are these analyses and projections so important? On the surface, a divorce settlement offer might appear en

Is there a life insurance policy to protect you and the children?

Do you know the future financial implications of what your husband wants versus what you want? What about other options?

And more.

Before you walk into that mediation room, you are going to want to scrutinize every aspect of your financial life. You’re also going to want to think about what you want to do next in your life—did you stay at home supporting your husband’s career and now need to find a job? Are you running your own business and need additional childcare? Are you a high-earner and worried about losing half to someone who refused to work? This might seem overwhelming but knowing the numbers and where you want to be post-divorce is essential to negotiating a realistic and viable settlement.

To be Empowered, You Must Take Power.

Let’s be honest, whether you want the divorce or not, the journey will not be easy. You WILL come out of the other side stronger, but there are no shortcuts. After years of helping women going through divorce, we’re experts at pro-actively addressing the known challenges and surprises you’re about to face. If you’re going to mediation, let’s have a conversation. Your success starts with selecting the right team, asking the right financial-related questions, and being prepared for every conversation and meeting. We’re here to help you navigate this trying time and come out ready and prepared to thrive.

Your Next Strategic Move? The BRIDGE™ Experience

Women almost always get the short end of the stick in divorce. But in this chess game, you’re the queen, girlfriend. Let us help you take power. While your ex thinks he's got it all figured out, you’re quietly preparing with BRIDGE™—expert financial coaching, a supportive community, and a proven strategy for your financial future. It's time to secure the settlement you deserve. 💼